We're going to talk to you today about the interest on a fixed income, and real estate, are two different asset classes and inverse correlation. When interest rates go up, your real estate will fall, and vice versa.

As an example, and compare them with the return of the NTN-B (which was the title of the government in the post-set and linked to inflation), with the yield of the Sief (real Estate Funds). Both of them are closely related. The Sief load caractéristicas that are similar to the fixed-income securities: (i) a high-previsilidade of free cash flow generation; and (ii) the distribution of 95% of your income such as income, (iii) leases of real property in the wake of the inflation. However, as we said, they are correlated negatively.

The interest rate is a variable that affects both the opportunity cost of the investor and the economy of the country. Interest rates represent the larger the discount rate in the calculation of the value of the asset, which represents the lower, the present value of those assets), and also the shortest in the country's development. In this scenario, the consumption (demand) to fall, leading companies, the decrease in investment and/or to narrow its operation, with a direct impact on the real estate assets via the increase in the vacancy rate and a fall in the price of the rental.

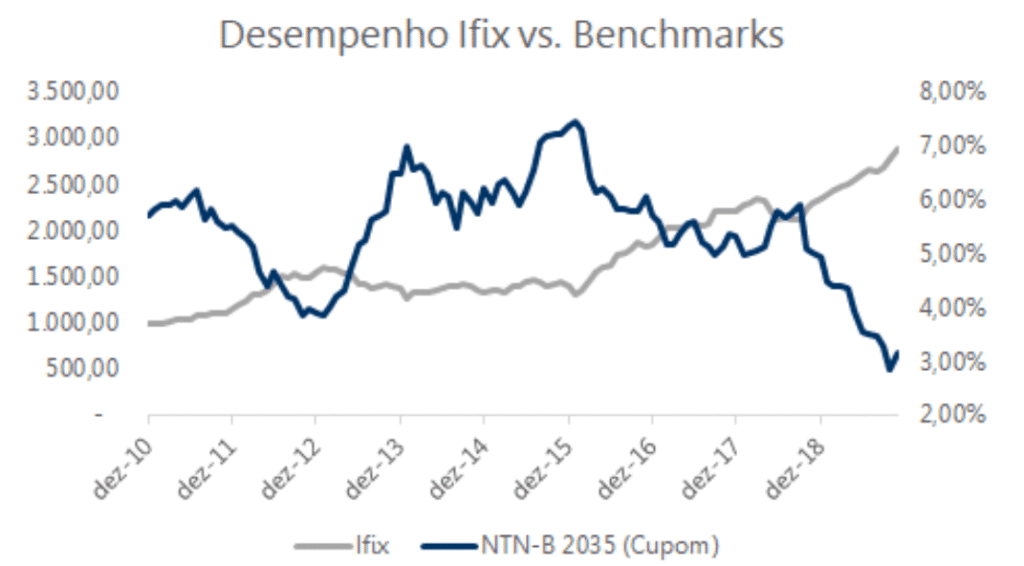

To be clear, let's get to the numbers. The chart below depicts the history of the case in the NTN-B, 2035, and in the case of the Ifix as of 2011, the window of time that includes both the strong economic growth of a country (2011 and 2013), such as the recent economic recession (2014-2016).

The lines that cross each other over time, but in the opposite direction. At all times, in the case NTN-B, 2035 is on the rise (high interest rates), with the yield on the Ifix has fallen, as in the period of 2013-2015, when the inflation-has exploded in the country and getting to double digits.

Interesting to note that the peak in the yield of the NTN-B-2035, was at the end of 2015 to 7.4% a a. a.. Since then, his career is in decline, is justified by the improvement in confidence in the country on a more liberal – in the first instance to the then-president Michel Temer, and the second president Jair, jair bolsonaro.

Both of them re-establish trust and confidence in the country, which, along with inflation under control, economic reforms adopted (for example: the roof of the costs of public and private pension plans), and low economic growth, helped by the Central Bank cut the Selic rate, fell from the highest level of the past few years, the 14,25% a a. a. a to 4.50% a a. a.. From there to here (2016-2019), all of the Sief, they did not cease to rise, and the valuation accrued, was more than 100%.

You may be asking yourself: if you still has room to fall further interest rate? The Ifix, you have the potential for appreciation?

Just to be clear, we're not economists, but we believe we have sufficient grounds for use of the Ifix sim, and an explanation follows.

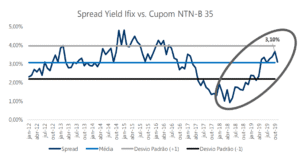

We love the look and the usability of the Ifix from the perspective of the yield of the Ifix against the case of the NTN-B-2035-the-spread. The chart below is the history of both of these.

Source: Bovespa, and the Treasury

The higher the spread, the more attractive it is to invest in the Sief. Historically, the average spread between the two is that of the 310 basis points, the maximum of 480 basis points, and a minimum of 90 basis points, shot just before the strike of truck drivers in 2018. Today, the yield on the NTN-B-2035, is at 3.2% in a. a. and in the case of the Ifix in 6.3% of the a. b. a.'s, and that it means the spread of 310 basis points in between.

What is the reason for the increase in the spread in the course of 2019?

On the contrary to what has happened in the past, especially during the period of 2016-2018, when the Ifix had a valuation higher than the NTN-B, 2035, and there was a decrease in the spread, at this time, the motion is a little bit different than the recovery of the NTN-B-2035 (+38%) was higher than in the Ifix (+27%) in the year, and it has increased the spread.

And what is the bottom line?

If we do an exercise with the latter back to the first standard deviation below the historical average of 220 basis points, based on the premise that, in the case of the NTN-B-2035 is to remain at the current level of 3.2% in a. a., we came to the conclusion that, in the Ifix has a space on the table in about 20%, or spread to enforce the 90 basis points.

Going further, one could even question whether the spread of the medium's future should not be less than the history of 310 basis points, since the liquidity of the Sief has more than tripled in 2 years, and the country's economy is based more robust than in the past (in inflation-controlled, low-interest loans to grow, businesses, less leveraged and more efficient, and the tax-controlled), and also the fact that the spread in the middle of the historic between the Treasury's 10-year, and the dividend yield of REITs americans to be reduced to 115 basis points. These aspects make it appear that they are not

built in. In this scenario, we would have to have an appreciation of the Sief.

In the end, we believe that, in the case of the Ifix has room for improvement via an increase in revenues (which is rare seen in the last few years), and in the face of the largest in the country's development, which, in turn, is reflected in a drop in the vacancy rate in the Sief in the brick (stone, corporate, warehouse, shopping mall, etc.) and the higher the rent. Factors that tend to reflect on the appraisal of the assets.