The Real Estate Funds (FIIs) market has consolidated itself as a relevant alternative for investors looking to diversify and generate passive income. Among the various classes of FIIs, real estate credit funds stand out. These funds invest primarily in fixed-income securities backed by real estate sector debt, such as Real Estate Receivables Certificates (CRIs). These financial assets have different risk profiles, which directly influences their composition within the funds and their evolution over time. Understanding these dynamics is essential for assessing market trends and investment opportunities

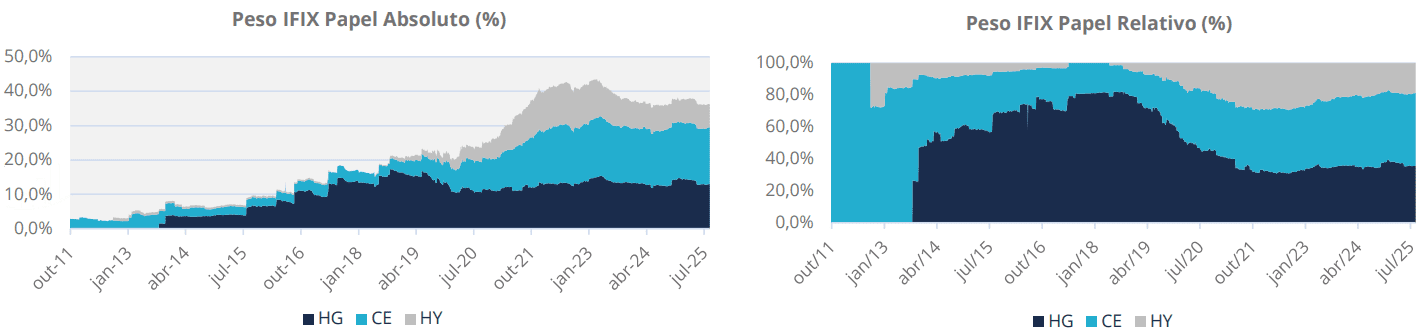

The charts below illustrate this transformation within the IFIX Index, which measures the performance of real estate investment funds (FIIs) listed on the stock exchange. It can be observed that, in recent years, there has been a decrease in the share of high-yield (high-risk) instruments, while high-grade (low-risk) instruments have gained more space. This movement reflects a growing search for greater predictability and security amid a more challenging economic environment. In addition, structured credit, which presents an intermediate level of risk, has also maintained a relevant role in portfolio composition, demonstrating the importance of diversification in managing these assets.

The Resilience of Structured Credit

While High Grade funds prioritize predictability and security, their profitability is naturally more limited. High Yield funds, on the other hand, which seek higher returns, are more sensitive to the macroeconomic environment and are affected by factors such as interest rate changes, external conditions, and credit volatility.

Structured credit positions itself between these two extremes, combining attractive returns with a controlled level of risk. The structuring of operations allows greater flexibility in asset management and risk mitigation, resulting in more resilient performance even during periods of uncertainty. In addition, this type of credit is often directed toward project financing, revenue prepayments, and inventory operations, providing additional diversification. This makes funds in this segment an appealing alternative for investors seeking a balance between profitability and security.

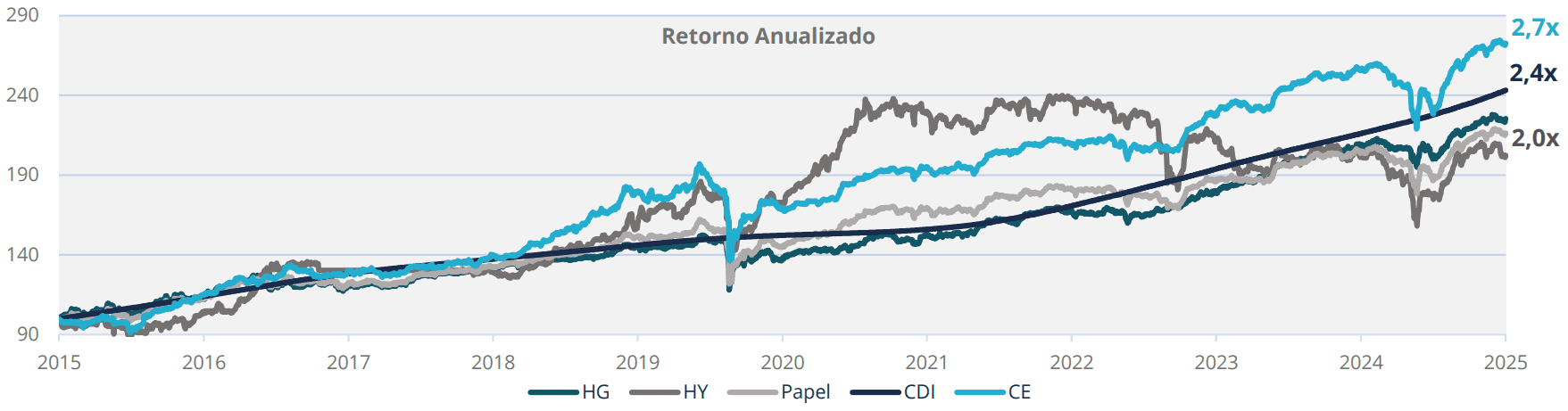

The chart above compares the total return of different segments within the real estate fund market. The performance of each category represents the weighted return of the FIIs in that segment, considering the variation in market price adjusted for dividend reinvestment. The analysis highlights the attractiveness of investing in Structured Credit (CE) over time, showcasing its superior performance compared to other asset classes. While the CDI maintained a linear trajectory and High Grade (HG) funds showed moderate growth, Structured Credit demonstrated consistent and strong performance, accumulating significant gains over the years.

Even considering periods of market volatility, the structured credit segment stood out by delivering strong returns, outperforming both the more conservative funds and the riskier ones, such as High Yield (HY) funds, which experienced periods of significant devaluation. This behavior reinforces the balance between risk and return offered by Structured Credit (CE), consolidating its position as an efficient alternative for investors seeking attractive yields without giving up security and predictability.

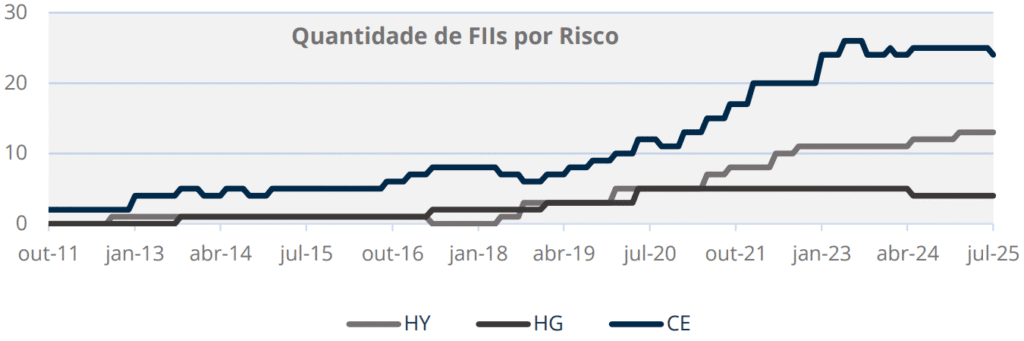

The consolidation of the Structured Credit (CE) thesis is evident not only in its superior performance but also in its validation by the market. The adjacent chart shows CE’s leadership in the creation of new funds — a reflection of the industry’s maturity and the growing demand for resilient strategies. In this scenario of a validated market and a winning thesis, it becomes essential to analyze the vehicles that execute it most effectively.

The RPRI11 Strategy: Safety and Value Creation

In this context of consolidation and diversification, RBR Premium Recebíveis Imobiliários (RPRI11) stands out as a Structured Credit (CE) fund. The fund specializes in investing in real estate debt operations with a fundamental differentiator: security. Each investment is designed with customized, proprietary structures, seeking maximum investor protection through a central pillar — the requirement of robust, real guarantees for each transaction.

This security is materialized in numbers: the fund operates with an average Loan-to-Value (LTV) of only 56%, which creates an important safety cushion for the invested capital. The quality of these guarantees is reinforced by the strong diversification of the portfolio and its privileged location: about 68% of assets are in the State of São Paulo, with 43% concentrated in prime areas of the capital such as Faria Lima, Jardins, and Pinheiros. This combination of premium location and low leverage reinforces the resilience of RPRI11’s structure.

| INDICATOR | VALUE |

| Net Asset Value | R$ 343MM |

| No. of CRIs | 24 |

| Average Duration | 3,6 |

| Portfolio Indexing | 86% IPCA | 14% CDI |

| Average MTM Spread | IPCA+ 11.63% p.a. |

| Average LTV | 56% |

| DY Average LTM | 14.28% p.a. |

| Average LTM distribution | R$ 1.04 |

Market Distortion

Even while maintaining a high-quality portfolio, with all its CRIs current on their financial obligations, RPRI11 continues to trade at a significant discount to its net asset value — currently around 12%. This level of discount represents an excellent opportunity, as the fund continues to deliver consistent returns while being priced below its real value.

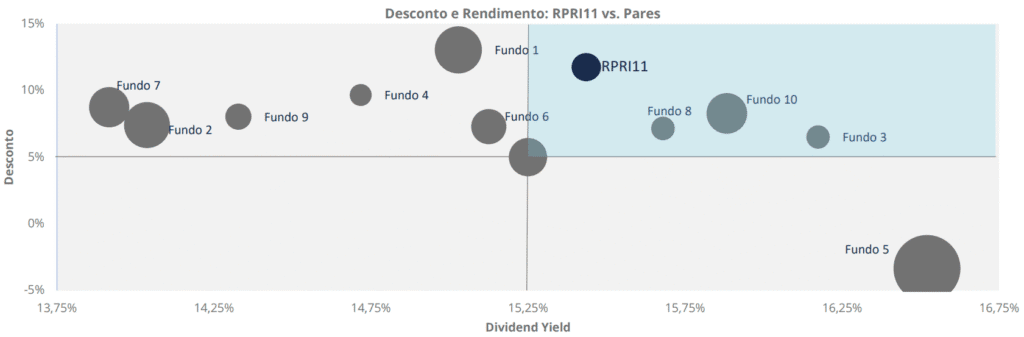

The comparative analysis illustrated in the chart was conducted based on a group of Real Estate Investment Funds (FIIs) within the Structured Credit (CE) segment, considered market peers of RPRI11. The data used refers to market closing as of May 2025. The Y-axis represents the percentage discount of the market price in relation to its Net Asset Value (NAV), while the X-axis indicates the fund’s Dividend Yield. Additionally, the size of each circle is proportional to the fund’s Net Asset Value (NAV), indicating its scale within the segment.

Window of Opportunity

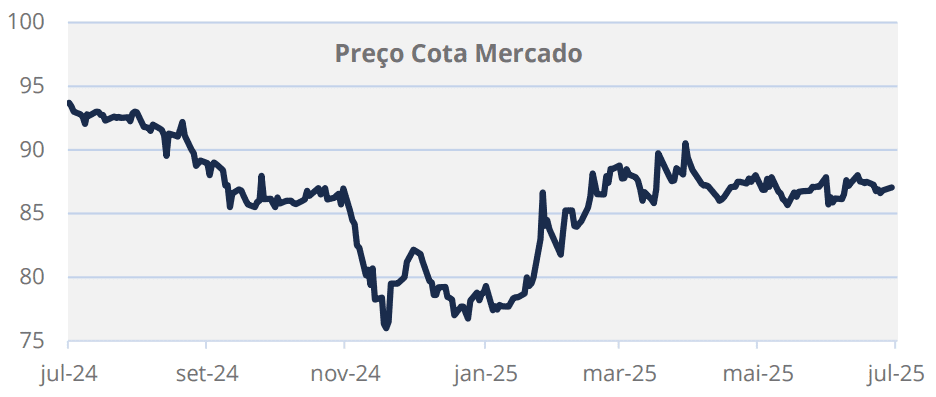

The recent recovery in RPRI11’s market price, as illustrated in the chart, signals a growing interest from investors and confidence in the fund’s resilience and management strategy. However, the main opportunity lies in the fact that the fund is still traded at a significant discount of approximately 12% to its book value. This distortion is particularly remarkable, as RPRI11 maintains a high-quality credit portfolio, with all 24 CRIs performing as expected and fully current.

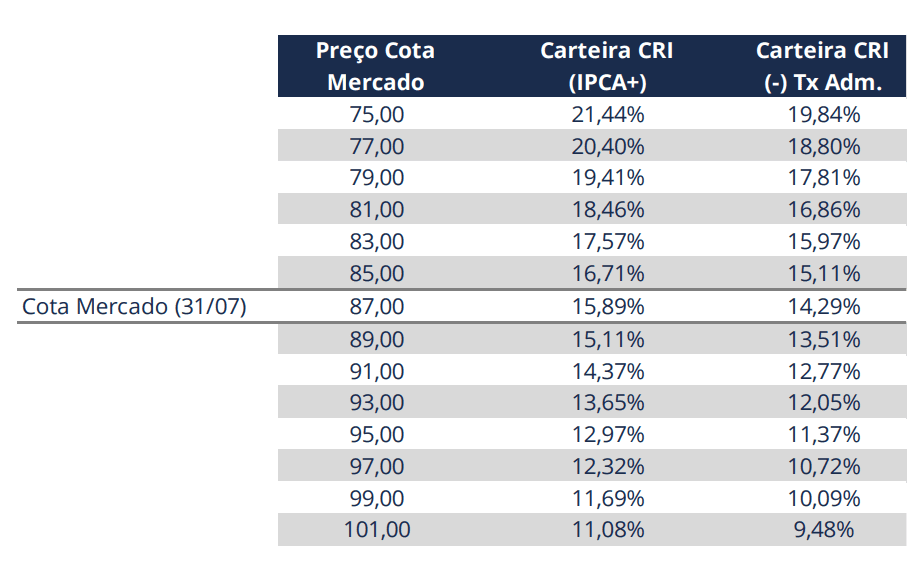

The sensitivity table quantifies this window of opportunity. As of July 31, with the market price at R$87.20, investors acquire a debt portfolio with an implied return of IPCA + 15.89% per year, before management fees. The analysis also demonstrates the investment’s margin of safety: even if the share price converges to its fair value of R$99.80, the portfolio’s return remains at an extremely attractive level of IPCA + 11.69% per year.

In this scenario, RPRI11 consolidates itself as a robust and high-conviction investment thesis. The strategy offers investors a rare combination of three value drivers: High and consistent current yield; Real protection against inflation, through a portfolio mostly indexed to IPCA; and Potential for capital appreciation with the eventual narrowing of the discount to book value. It represents a strategic allocation for investors seeking a superior security structure, with asymmetric return potential and active, specialized management.