Abstract

Understanding

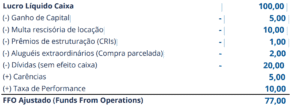

On the net, and as a result, the dividend may suffer from various kinds of noise. This is one of the challenges in the analysis, since they are not all of the funds to make it clear which factors have an extraordinary impact in their outcomes. Examples are:

- Capital gains | The sale of property could have an impact on the outcome of several months, in the case of the receipt is to be divided. As a Sief is on a cash basis, and the recognition of this gain or loss is also likely to be divided. In some cases, the payments can last for years, making it more difficult to read than to be a non-recurring event.

- Buy Split | As well as from the sale, to purchase, occasionally it also generates a tremendous effect on the outcome of the case. In the majority of cases, the fund recognizes 100% of the rental price, even having a paid up to 50 per cent of the asset, for example. In this case, in order to investigate the long-term, it is necessary to consider both the values in the same database.

- Debt | Also, on account of the recognition-of-the-box, leveraged funds have different ways of counting. In the periods of insurance, the financial burden may appear to reset to zero in the STATEMENT. However, at the time of repayment, shall have the effect of-the-box, and it can have a negative influence on the dividend. To arrive at FFO, Adjusted, it is necessary to add all of the expenses related to the period of time, even if you do not have the effect of-the-box in both the inflation and the interest rate.

- Fees, Premiums and Discounts, The amazing effects-both positive and negative, can have an impact on the operating income of a variety of ways. For example, in the event of the termination of a contract of chance, and the tenant shall pay for all or part of the amount remaining on the contract, you do not necessarily have a one-time process. The same is true of discounts on investments and rewards of design-thinking about Chris.

FFO as Adjusted, in practice, Funds and Logistics

To illustrate this better, such as the difference between the Adjusted FFO is estimated, and the dividend can be considered representative, we used information from the main backgrounds in logistics, at the end of April, 2024. As you can see below, most of the funds with events that are extraordinary, representative, coming in at 15%, and 20% of the dividend for the current one. As part of the review, it is important to design a load-off after the end of the extraordinary events; otherwise, the item cannot be overestimated, and in some cases, estimated.

In addition to this, when you compare it to the funds, it is common for the comparison at the level of the Dividend Yield. The funds, which are at times opposed, for example, on the one hand, the realization of the six months, due to a strong gain in the capital, and on the other, to constitute an important part of those assets that are in the waiting period of the contract, it can present a distortion of the comparative is so significant that it cannot be analyzed by the Dividend Yield.

On the other hand, a lot of times, extraordinary events are the result of the active management of the fund, with the destravas the value and efficiency in the design of the capital city. The team of dividends and FFO as Adjusted, are not mutually exclusive, but rather complementary to each other.

History

At the beginning of the history of the Sief, even after the appearance of the IFIX at the end of 2010, the major part of the funds was made for the fund's liabilities, monoativos and gross. The design of the bottoms was more acquisitions that were not supported by, or paid to, and the sales were not trancheadas. Thus, the dividend was often sufficient for the analysis of a fund.

Over time, the industry has been refined. Sief Chris didn't have an expression on the index, up to 2014/15, but today they account for nearly half of the IFIX. The industry in FOFs has also earned a spot last year, followed by Hedge Funds. The industry has grown by more than 10 times. In the same manner, format, structure, and the products are becoming more complex, and of course, the analysis of the funding also needs to evolve, taking into account multiple metrics, and methods, such as FFO, Adjusted, SPECIFICATION, INSTRUCTIONS, and other.

The Sief gain importance, and cash. Pension funds, multi-strategy, and even international sources are allocated to the funds in real estate. Over time, in the form of a review of the Multiplan (MULT3), it should not be that different from the analysis of the XP-Malls (XPML11), for example.