In the past few weeks, we have been accessed by a number of investors with respect to the REITs (Real Estate Investment Trust) in the united states, vehicle is equal to the Sief in Brazil. The sharp drop in REITs, which stood at 35% in the year to the appreciation of the Dollar relative to other currencies, and the low level of interest rates in the U.S., and the world's, and many other factors have been the drivers of this interest. We decided to write this article is to present an overview of the north american market for REITs, and the present moment.

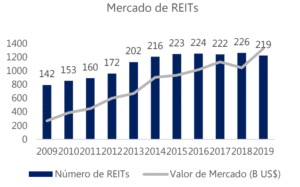

The fair market value of the REITs in the U.S., totaling more than US$ 1 trillion (approximately 50 times greater than that of the market in the Sief), and is accessed by more than 20% of the population in the united states. However, unlike the case in Brazil, where investors and individuals to invest directly in REITs, the major player in this market in the us is the institutional investor (corresponding to 80% of the market that the vast majority of which is represented by pension funds, insurance companies and ETFs (Exchanged-traded Funds) in such a way that the participation of the people in físcias in the market for REITs is carried out in an indirect way.

Source: NAREIT, and RBR, Asset Management

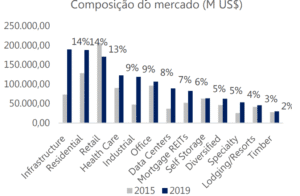

There are at least 220 REITs in the u.s. market. As long as there are REITs with a market value of tens of billions of dollars of American Tower (AMT) and $ 100 billion, and Prologis (PLD) of the $ 80 billion, and there are other smaller ones (less than The $ 1 billion). Important to note is that the same as the REITs in a small size that are larger than the large real estate funds in the market. The investments are spread over several segments of real estate: residential, commercial, industrial and infra-structure (cell tower), data centers and timber (forestry assets), a senior-living room, diversified (casino, ski, movies, etc.), the distribution of which is very diverse and

Source: NAREIT, and RBR, Asset Management

Another interesting aspect that is different from that of the Sief, the local structure of the capital. The REITs in the middle have the financial leverage a comfortable 40% of its assets, and the coverage ratio of the debt to the more than 2.5-fold. If, on the one hand, financial leverage, giving a more dynamic management of REITs in order to widen the return, in times of economic growth, on the other it adds an element of risk in the structure can lead to major losses, at the moment of the conditions and dynamics that is different from the Sief, that you are not allowed to cash.

The organizational structure of a REIT that is very similar to the company's properties, which trades on the Stock exchange in brazil. That is to say, they have a whole struct for the people and the cost of operating business, such as the areas of legal, business, marketing, and finance, among others.

The management of the REIT is carried out by a team of executive directors, and not by a company hired for the job, and that these officers paid for wages and salaries, bonuses and stock options. A REIT effective it is well-known for the expenses of the staff of less than 0.20% of the value of the market. There is also a strong corporate governance, including advice, independent of the Board, also free of charge, and providing oversight of the executive directors of the REITs.

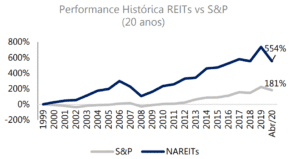

Source: NAREIT, and RBR, Asset Management

The REITs offer a good risk/return ratio. Historically, when we look at a window of 20 years, and have delivered a cumulative return over all benchmarks, including the S&P 500, as you can see in the chart above. In addition to its volatility, it is ligeriamente the bottom, making this an excellent option for the investor's point of view, the diversification, as it allows for the access of the different segments of the real estate of american-and global-and with the daily liquidity is high.

It is still a challenge for the most of the local investors to invest in REITs in the U.S., due to the need to open accounts with brokers, the local impact of the fiscal in Brazil and other countries, reduced access to information, locations, and other factors. The RBR is very focused on the drill on the market, REITs, and is, in short, a product that enables you to access the local investor of such opportunities.